Exactly How a Financial Debt Loan Consolidation Car Loan Functions: Trick Insights Into Taking Care Of Financial Obligation Efficiently and Improving Credit Report Scores

Recognizing exactly how a financial debt combination car loan features is important for people looking for to manage their economic obligations much more properly. By settling multiple financial obligations right into a single finance, borrowers can improve their settlements and potentially benefit from lower rate of interest rates. This critical strategy not just streamlines the settlement procedure yet can also enhance credit rating scores in time. Nevertheless, the performance of this method hinges on keeping disciplined economic habits post-consolidation. As we explore the complexities of financial debt consolidation, it becomes evident that the trip requires more than simply a car loan; it needs an extensive understanding of personal financing administration.

Comprehending Debt Combination Lendings

Financial debt debt consolidation fundings serve as an economic approach developed to simplify numerous financial obligations right into a solitary, workable settlement. This method entails acquiring a new loan to settle existing financial obligations, which might consist of credit rating card equilibriums, personal finances, or other types of loaning. By consolidating these financial obligations, individuals can typically gain from reduced passion prices, reduced regular monthly payments, or prolonged settlement terms, hence alleviating the economic worry.

Commonly, debt consolidation finances been available in two main forms: protected and unsafe. Safe fundings are backed by collateral, such as a home or automobile, which may permit lower rates of interest however also poses a threat of shedding the asset if settlements are not maintained. Unprotected lendings, on the other hand, do not need collateral yet may lug higher passion prices because of the raised danger for lenders.

Qualification for financial debt consolidation financings is contingent upon numerous aspects, consisting of credit score score, earnings, and debt-to-income ratio. It is critical for consumers to thoroughly examine their monetary situation and consider the total price of the financing, consisting of charges and passion, before waging financial obligation loan consolidation. Comprehending these elements is important for making informed financial decisions.

Benefits of Financial Obligation Consolidation

Countless people discover that settling their financial obligations uses substantial advantages, ultimately causing enhanced financial stability. Among the primary benefits is the simplification of month-to-month payments. contact us today. Rather of taking care of several payments with differing due days and interest prices, debt loan consolidation allows customers to concentrate on a single repayment, which can minimize stress and improve economic company

Additionally, financial obligation loan consolidation can commonly lead to reduced passion rates. By protecting a car loan with a reduced price than existing financial debts, individuals may conserve money gradually, raising their ability to settle the principal balance quicker. This change can contribute to a decrease in the overall cost of borrowing.

Additionally, settling financial obligations can favorably influence credit rating. As individuals pay down their debts extra effectively, their credit usage ratio boosts, which is a crucial factor in credit rating models. This can open doors to much better financial chances, such as certifying for finances or credit history cards with a lot more beneficial terms.

Finally, debt consolidation can offer an organized payment plan, making it possible for individuals to establish clear economic goals and job in the direction of ending up being debt-free, promoting a feeling of empowerment and control over their monetary futures.

Types of Debt Debt Consolidation Loans

Consolidation financings come in various forms, each customized to satisfy different financial requirements and situations. One common kind is a personal lending, which allows debtors to combine numerous financial debts right into a single lending with a fixed rates of interest. This alternative is typically unsafe, meaning no collateral is needed, making it accessible for several consumers.

Another prominent choice is a home equity finance or home equity line of credit report (HELOC), which leverages the customer's home as security. These alternatives usually include reduced rate of interest as a result of reduced danger for lenders, but they call for enough equity in the home and carry the threat of foreclosure if repayments are not kept.

Credit scores card equilibrium transfers are also a practical kind of debt combination, permitting individuals to transfer existing bank card equilibriums to a brand-new card with a reduced rate of interest, frequently with an initial 0% APR. While useful, this method requires mindful monitoring to stay clear of incurring even more financial debt.

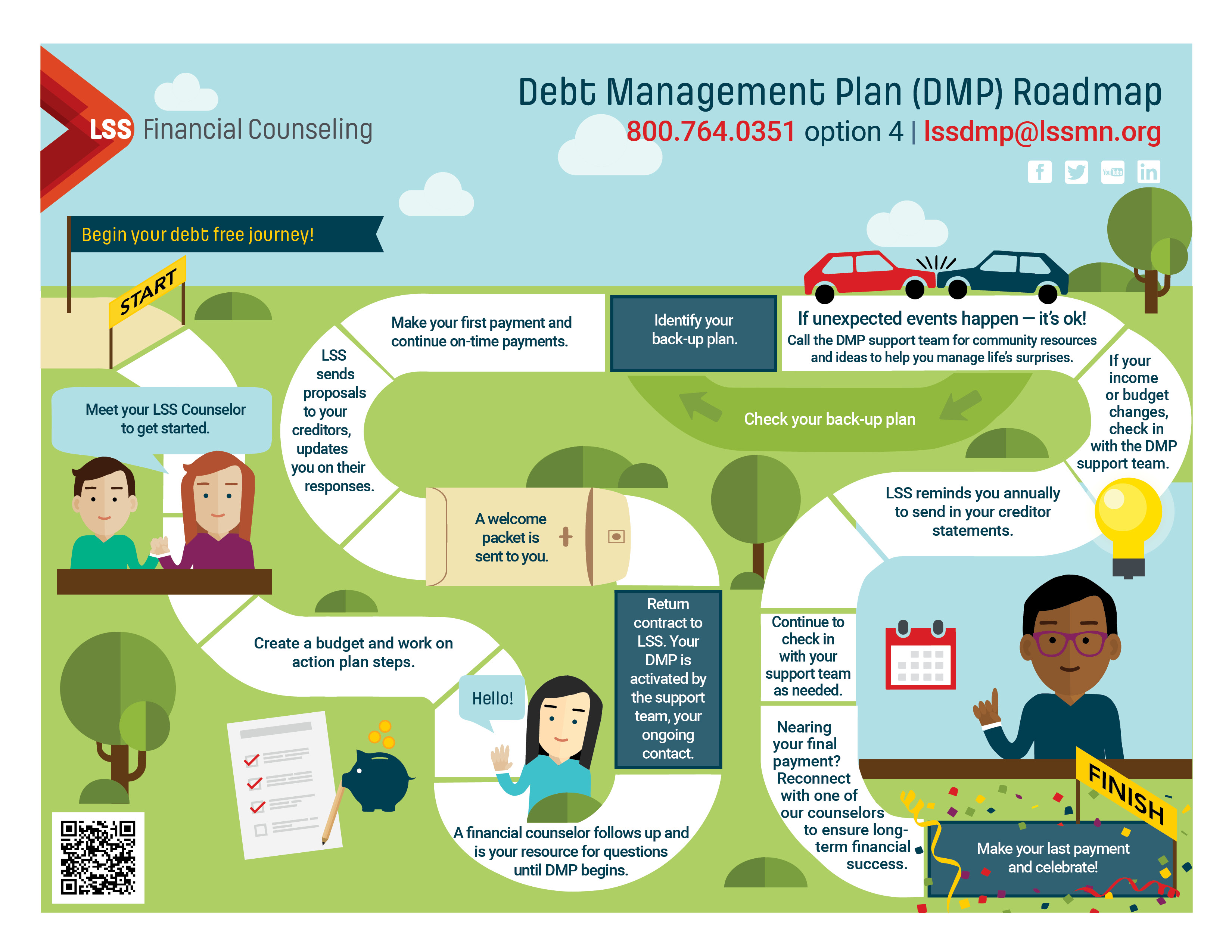

Lastly, a financial debt monitoring strategy (DMP) arranged by a credit counseling company can likewise consolidate financial obligations, discussing lower rates of interest and monthly payments with creditors. Each of these options presents unique advantages and considerations, making it vital for debtors to assess their monetary situation thoroughly.

Steps to Obtain a Debt Combination Funding

Following, inspect your credit rating, as it plays an essential function in funding approval and terms. If your rating is low, consider taking steps to improve it prior to applying, such as paying down existing financial obligations or fixing any kind of mistakes on your credit record.

Afterward, study various lending institutions and funding options - contact us today. Compare rates of interest, terms, charges, and eligibility requirements to determine the very best suitable for your requirements. It's additionally advisable Visit Your URL to collect required paperwork, such as evidence of revenue, income tax return, and identification, to speed up the application procedure

Once you have picked a lender, send your application, making sure that all details is total and precise. Ultimately, review the finance terms carefully before signing, guaranteeing you recognize all obligations. Complying with these steps will help you secure a debt combination car loan successfully.

Effect On Credit Report

While getting a financial debt loan consolidation financing can supply prompt remedy for high-interest financial obligations, it is necessary to understand its prospective effect on your credit rating. Originally, requesting a loan consolidation car loan may result in a hard questions on your credit history report, which generally causes a mild dip in your rating. However, this effect is typically temporary.

Once the loan is secured and existing financial debts are repaid, your credit scores usage ratio is likely to enhance. Since credit history utilization make up about 30% of your credit history, minimizing the percentage of debt about available debt can cause a favorable change in your rating in time. In addition, combining numerous financial obligations into a single lending streamlines settlement, potentially minimizing the threat of late repayments, which can better enhance your credit rating profile.

Verdict

In conclusion, financial obligation loan consolidation fundings serve as a critical device for taking care of numerous debts by integrating them into a solitary, possibly lower-interest financing. This strategy simplifies the payment procedure and can bring about improved credit report with enhanced credit rating usage ratios. However, it is necessary to preserve regimented economic habits following loan consolidation to prevent the mistakes of new financial obligation build-up, which can weaken the benefits attained through this monetary technique. Accountable management remains essential for long-lasting success.

Financial obligation consolidation car loans offer as a financial technique developed to simplify multiple debts into a single, workable settlement.Qualification for debt loan consolidation car loans is read review contingent upon different variables, consisting of credit report score, debt-to-income, and income ratio. One typical type is a personal finance, which permits consumers to incorporate numerous financial debts into a solitary financing with a fixed rate of interest price.While getting a financial debt combination car loan can offer immediate relief from high-interest financial obligations, it is important to recognize its potential effect on your credit report rating.In final thought, debt consolidation loans offer as a tactical tool for Get the facts handling numerous financial obligations by amalgamating them right into a solitary, potentially lower-interest car loan.